Insurance Importance Of Nomination

Why should you make a nomination. Your first choice of.

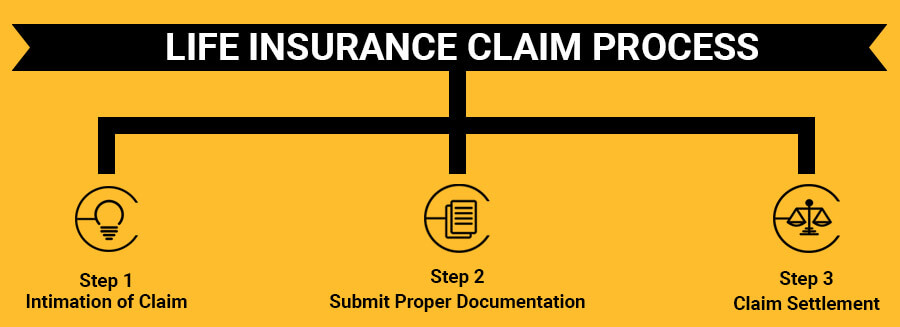

Life Insurance Claim Process And Required Documents Policyx Com

In the absence of a proper nomination the real beneficiaries are determined by various factors.

Insurance importance of nomination. TLDR What Do I Need To Know About Insurance Nomination. The rules for nomination in life insurance have changed for insurance policies maturing after March 2015. It will be the nominee who will receive the proceeds of your life insurance policy on your demise.

Selection of nominee ensures that the life insurance company knows whom to pay the assured money after the demise of the policyholder. It is not wise to make insurance nomination to minors children. In order to prevent the above situation from happening to you you will need to contact your insurance provider or pension provider and ask for a nomination form which will enable you to input your intended beneficiarys details.

Insurance policy. It gives you some basic information to help you understand the nomination. So in case of an eventuality the insurance company pays the policy proceeds to the appointed person called Nominee.

Proper nomination in Life Insurance is important to ensure that in the event of death the life insurance claim money goes into the right hands. Importance of Having a Nominee On a Life Insurance Policy In a life insurance policy the policyholder nominates a person to whom the insurer must pay the policy proceeds in the event of hisher demise this person is called the nominee. Here are the disadvantages of insurance nominations.

In simple words a nomination is a process of selecting one or more nominees for your policy. Insurance nomination is useful if the death proceeds of a policy is solely for an entity who is guaranteed to be capable of receiving it such as a living trust. Nomination in life insurance has one limitation as insurance policies are bought to secure your financial dependants.

Nominee is supposed to hold the funds on behalf of the legal hiers who would be mentioned in the will or determined by the rules of succession. Well to save time and hassle. The process of selecting that candidate or Nominee is called Nomination.

Nomination in Insurance Nomination of Life Insurance Policies is a process whereby if the Life Insured dies within the policy tenure the Insurer would pay out the proceeds of that policy to the Nominee. The insurance company will settle the amount to the nominee. As per the Insurance Act while the nominee shall be paid but the nominee may not be the legal hier to the funds.

A policyholder can nominate any person usually a close relative to receive the money from the insurance company if he. Acknowledging these terms helps the policyholder to extract the benefits available under the life insurance policy without making a hole in hisher pocket. The benefit of nomination is that in the event of the death of an account holder the Bank can pay the amount lying in the account of the deceased to the nominee without insisting for a.

Nomination in Life Insurance- The policy holder can nominate a person as nominee while he is alive to receive the claim amount in case of his death. Nomination is part of the process by which the Policyholder can nominate anyone to whom the policyholder wants the financial benefits to accrue in case of hisher death during policy tenure. Importance of nomination in a life insurance policy.

In life insurance plans Nomination and Assignment are the two important terms that are frequently used. Nomination in Life Insurance A policy holder can appoint multiple nominees and can also specify their shares in the policy proceeds. Nomination is only an authorization to some one to receive the policy money if and when the policyholder dies.

Making a nomination The purpose of having life insurance is to ensure that your loved ones are protected financially should anything happen to you. In simple terms making a nomination in your life insurance policy means choosing someone to receive or manage the money disbursed by the insurance company when you die. I wish it was that simple though for there are several things that you should know before rushing into making a nomination.

It could be your spouse parents children distant relative or even a friend. In case there is a Will then the nominee has to settle the amount as per the Will. What is Nomination in a Life Insurance Policy.

A stitch in time saves nine. It is then important that your loved ones can access the funds quickly. Making an insurance nomination allows you to distribute your policy proceeds to your loved ones according to your wishes.

Importance of making a nomination Introduction This is an introductory guide to help you understand the importance of making a nomination in your life insurance policy to safeguard the interest of your loved ones.

Difference Assignment Vs Nomination In Life Insurance Policyx Com

Life Insurance Google Search Life Insurance Life Insurance Beneficiary Life

Term Insurance Calculator Helps You To Calculate Online Term Insurance Premium Payable For Life Life Insurance Calculator Life Insurance Policy Term Insurance

What Is Beneficiary Nominee Nomination Importance Rules And Benefits

Can I Use My Will To Distribute Insurance Proceeds Singaporelegaladvice Com

How To Choose Nominee For Insurance Policy Businesstoday

Insurance 101 What Is Insurance And Why Do You Need It

The Below Write Up Can Elaborate Additional On The Way To Open A Demat Account Importance Of Nomination The Way To Convert Your Phys Accounting Open Writing

The Importance Of Insurance Policy Nomination In Singapore

Pradhan Mantri Suraksha Bima Yojana And Jeevan Jyoti Bima Yojana Accident Insurance Bima Life Insurance

Http Insuranceblog Asia Wp Content Uploads 2017 05 Elgibility Conditions Jeevan Umang English 45 Years How To Plan Conditioner

Pin By Milifemistyle On Mi Lifestyle Marketing Business Building Direct Selling Companies Life

6 Tier 2 Banks Rakes N32b In Fee And Commission Income In 6 Month Income Rakes Bank Fees

The Importance Of Insurance Policy Nomination In Singapore

Insurance Consumer Protection A Video Series To Empower Consumers Empowerment Consumer Protection Insurance

Importance Of Making A Nomination Life Insurance Corporate

Importance Of Nominee In A Life Insurance Abc Of Money

Faq Can I Change My Nominee If Yes How I Changed Change Me Faq